Auckland Property Market Commentary – July 2021

Office market

Auckland’s central city office market is still adjusting to the impact the COVID-19 pandemic has had on the demand for office space within the CBD. The adoption of changes in workplace practices along with falling demand for space from educational and tourism related businesses has led to growth in the amount of vacant office space. Businesses have adapted to the changed environment and appear to have built in a more flexible approach to how they operate and are allowing staff to work from home or other remote locations. This has had the added benefit of reducing congestion and decreasing time employees have spent travelling to and from work. Market estimates suggest over 80,000m² of space is now available for sublease within the CBD as organisations have reassessed how much space they require and whether co-location strategies better suit their business models going forward.

Secondary quality space experienced the most significant reduction in demand as tenants have continued to prefer better quality office space. In addition, there has been increased demand for 4 Green Star rated or better Green Star rated buildings. Government tenants in particular require good quality 4 Green Star or better rated space. Rental growth is flat at best, reflecting increased leasing options available to tenants.

The metropolitan office market has experienced mixed outcomes. The fringe city office market in particular has experienced a fall in demand for space and as a result, the area of vacant space has increased. Rental growth is unevenly distributed across the metropolitan market’s precincts, with secondary quality space experiencing the largest softening in rents.

Demand for office building investments has remained steady with prospective purchasers focused on the security of future cash flows including properties’ weighted average lease terms and the strength of tenant covenants. There has been a small increase in interest from vendors to sell some of their existing office investments to take advantage of existing low yields and to consolidate their portfolio in light of potential interest rate rises.

Industrial market

Auckland’s industrial market has weathered the impact of the COVID-19 pandemic better than the office and retail markets. Growth in demand from tenants has continued to increase, particularly in South Auckland. Vacancy rates have continued to remain low by historical standards and rents have continued to increase. A lack of quality buildings available for lease as well as growth and tenant demand for quality new space is driving ongoing development activity. Land values in prime locations have continued to increase as there is an expectation of an ongoing shortage of suitably zoned and serviced developable sites close to the major transport networks. Developers are struggling to retain their margins with rising land values and building costs, and tenants’ reluctance to accept higher rents.

Low interest rates, combined with investor demand for industrial buildings, has continued to drive increased sales volumes. Industrial property investment returns have increased and have continued to outperform office and retail property investments.

Retail market

New Zealand’s retail sector has come under increased pressure with the COVID-19 pandemic disrupting the normal pattern of retail sales. Changes in household spending have redistributed both the location of sales and the type of goods and services consumed. Changes in workplace practices such as people working from home for part of the week, increased online/non-store sales, and households spending money that would have otherwise been used for international travel have been the key drivers.

Retailers went into the COVID-19 pandemic with tight profit margins. The impact of their profitability has been significant, although unevenly distributed by store type. These trends are likely to impact on the level of rent retailers can afford to pay. While some retailers will profit from the changes in sales activity, others may find trading increasingly difficult which could result in increased store vacancies. Retailers may struggle to pay higher rents in the short to medium term which could result in the mix of retailers evolving in some locations. Despite the current trading environment, investor demand for quality stock continues to increase with increased downward pressure on yields.

Outlook for Auckland region

The economy has continued to outperform market expectations. Over the last 12 months economic activity in Auckland has been building momentum. Labour market conditions have tightened with unemployment at 4.7% and businesses reporting difficulty in finding skilled staff. Activity in the construction sector has led to growth supported by low interest rates and a housing supply shortage built up over past years. Strength in the construction sector has also benefitted manufacturing businesses. The market expectation is for this growth to continue with residential construction activity underpinning future economic expansion. Poor housing affordability in the region has been one of the drivers for an increasing number of New Zealanders shifting out of the city to other parts of the country. This, combined with the growing expectations of higher interest rates, may temper future growth.

Although the outlook for the economy has improved over the last six months there is still uncertainty. The potential impact of the COVID-19 pandemic on both New Zealand and our key trading partners remains a persistent risk and limits our ability to reopen our borders to overseas travellers. However, overall Auckland should perform better than some regions. Growth in regional economic activity is expected to continue to support demand for commercial and industrial space in the city.

Property market outlook and sales activity

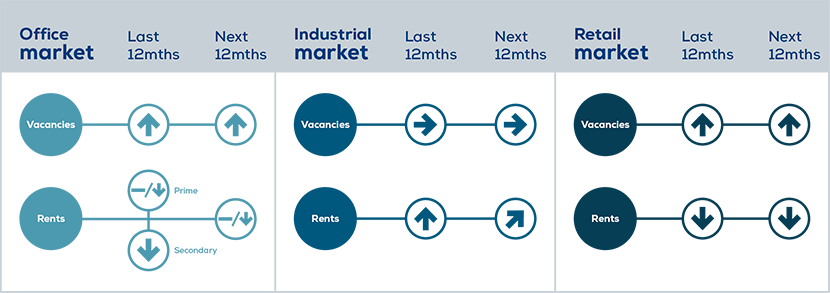

Table 1 presents the trend in key market indicators by market sector.

Table 1: Property market indicators

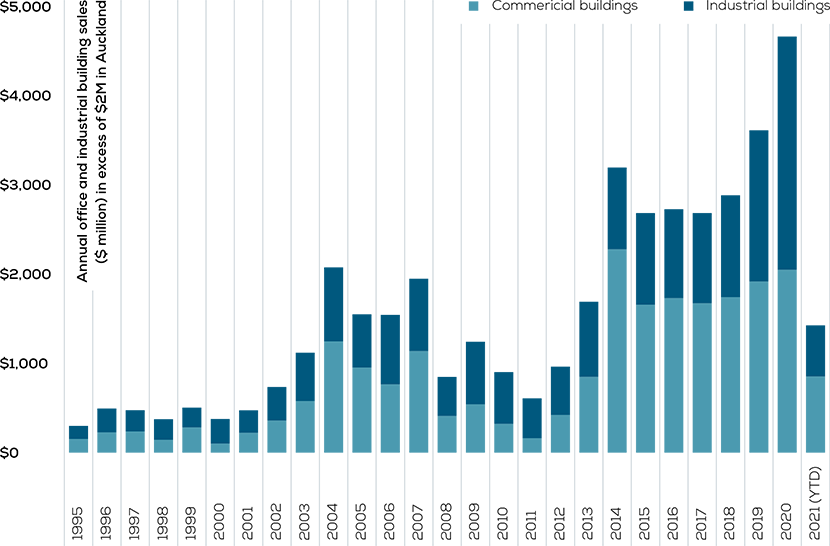

Figure 1 presents the growth in the value of commercial and industrial building sales in the Auckland region for sale prices more than $2 million.

Figure 1: Commercial and industrial building sales (properties selling for more than $2m in Auckland)

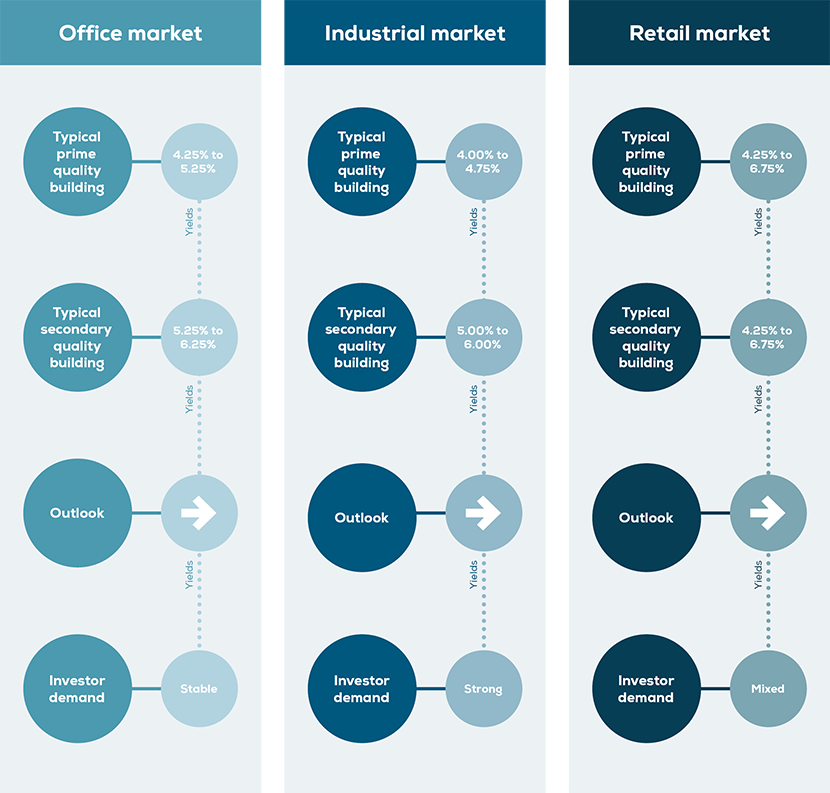

The volume of sales activity in 2020 was strong with the volume of sales limited by the number of buildings being offered for sale. Demand in 2021 remains robust for good quality investment opportunities. Table 2 summarises current yields by sector, their outlook over the next six months and the level of investor demand.

Table 2: Yields and investor demand by sector

Investor demand for good quality property investments is likely to remain robust and once the outlook for the economy becomes more certain, investor activity may increase. Growing inflation pressures have increased the prospect of higher interest rates in the short to medium term. This may encourage some existing owners to sell, however, there are limited alternative investment opportunities available.

Disclaimer:

Every effort has been made to ensure the soundness and accuracy of the opinions, information, and forecasts expressed in this report. Information, opinions and forecasts contained in this report should be regarded solely as a general guide. While we consider statements in the report are correct, no liability is accepted for any incorrect statement, information or forecast. We disclaim any liability that may arise from any person acting on the material within.